Land Tax was levied between 1692 and 1963. As the name suggests from the 1730s onwards it was levied mainly on land, based based on rental assessments made in 1692. The tax was collected locally but spent by the central government.

Land Tax assessments for individual parishes generally provide the name of the landowner, the name of the occupier (after 1772), and the amount of the assessment. From 1780, payment of land tax on freehold property worth £2 or more a year qualified a man to vote. In 1798 it became possible for landowners to exempt their property from the Land Tax by voluntary redemption, on payment of a sum of money.

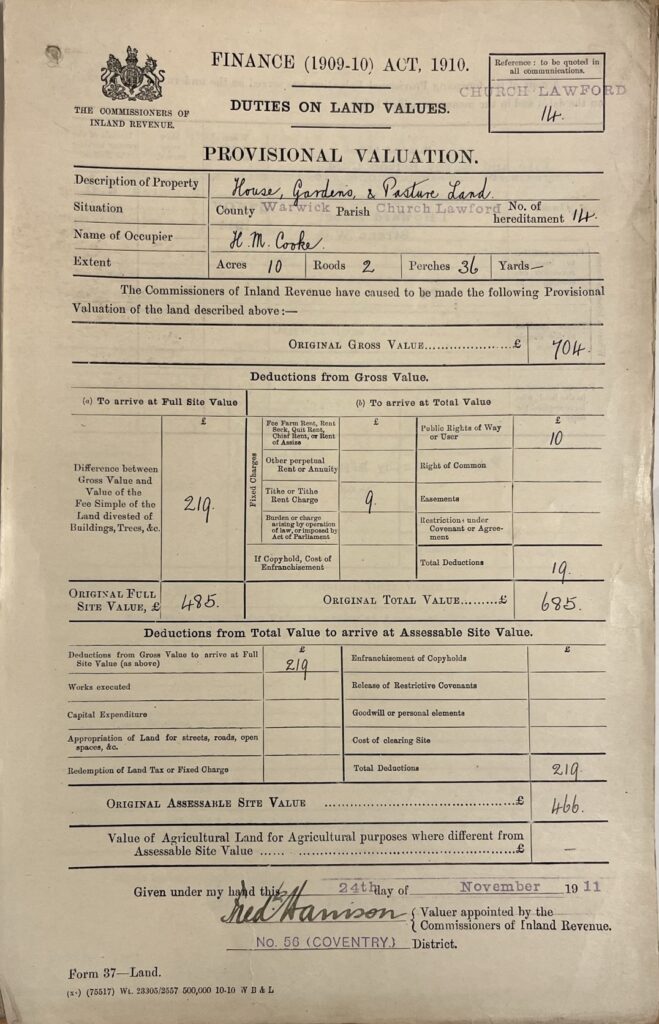

In the early 20th Century there was a further valuation of land for taxation purposes – these valuations are held at the County Records Office, and a sample is shown below.